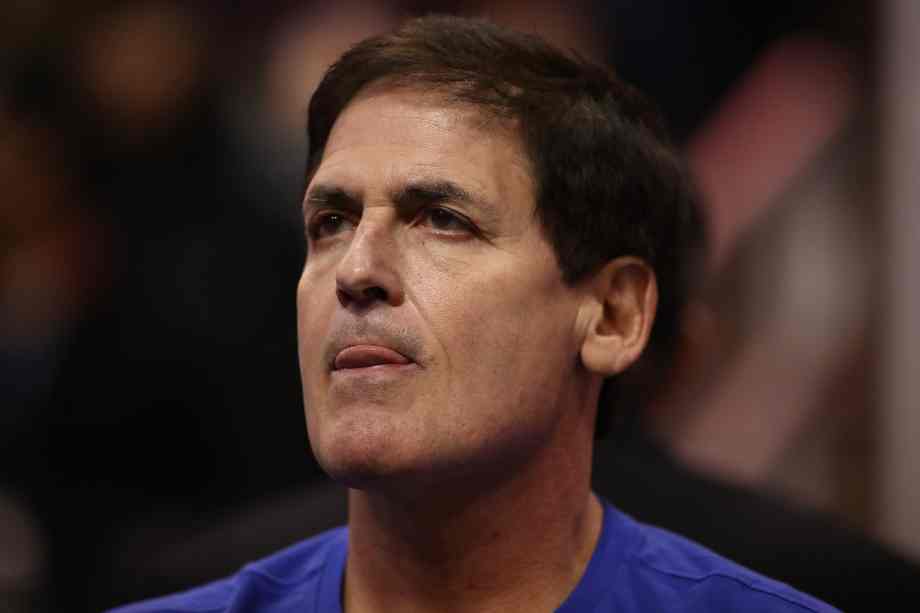

Why Mark Cuban Is ‘Dipping His Toes’ Into Shopping for Stay Nation Inventory as Costs Plummet

Amid the inventory market turmoil that has worn out basically all the good points made throughout Donald Trump’s presidency, billionaire investor Mark Cuban says he is a purchaser — and one among his inventory picks is very uncommon.

The star of Shark Tank appeared on CNBC by telephone Wednesday to say he is investing as much as 1.5 p.c of his accessible money into shares on every day markets go decrease, which has been the case most days prior to now month because of the coronavirus emergency.

Whereas Cuban has largely been plowing cash into an exchange-traded fund that tracks the S&P 500 — an index of 500 of the biggest firms listed within the U.S. — he is additionally scooping up shares of Stay Nation Leisure, a curious selection contemplating the enterprise it is in.

As its title implies, Stay Nation produces, promotes, supplies ticketing for and owns dwell reveals and venues throughout the globe, together with Ticketmaster and The Home of Blues. In its newest fiscal 12 months its income grew 7 p.c to $11 billion, although it’s anticipated to take a serious hit this 12 months with concert events, sporting occasions and different reveals canceled or postponed worldwide.

Shares of Stay Nation are off a whopping 68 p.c to this point this 12 months, and on Wednesday alone they have been dropping 32 p.c. Apparently, that is perhaps an overreaction, therefore Cuban is shopping for — or, as he put it, “dipping his toes” into shares.

Cuban, who additionally owns the Dallas Mavericks, which is on hiatus together with the remainder of the NBA, mentioned he is taking earnings on his put and name choices as a result of “the premiums are simply unbelievable.” Places and calls enable buyers to lock in future purchase and promote costs for shares.

“It seems like we’re beginning to get right into a buying and selling vary — up 5 p.c, down 5 p.c, up 5 p.c, down 5 p.c, and I am not fairly positive why,” Cuban mentioned Wednesday. “I am going to dip my toe within the water hoping that two years from now this can all be a nightmare that we put behind us and the market can be a lot increased.”

Cuban, 61, famously co-created Audionet in 1995 to webcast Indiana Hoosier basketball video games and renamed the agency Broadcast.com, which he later bought for $5.7 billion to Yahoo for inventory, which he cashed out at a really fortuitous time. His funding recommendation has been extremely sought ever since, particularly after rising his profile for 9 years because the star of Shark Tank, a actuality TV present the place entrepreneurs search funding capital from billionaires.

Cuban additionally mentioned throughout his 13-minute CNBC interview that he is paying his staff who aren’t allowed to work through the shutdown of the NBA, and, within the wake of coronavirus, he inspired firms in each trade to situation inventory to their staff, simply as they do for high managers.