After GameStop Debacle, Robinhood Faces Unsure Public Providing

The favored inventory buying and selling app Robinhood got here underneath fireplace on the finish of January for limiting customers’ potential to buy sure extremely risky shares like GameStop and AMC. Whereas founder and CEO Vladimir Tenev has claimed the sudden surge in buying and selling brought on sure safety deposit necessities to go up in smoke, the halt in buying and selling was an plain think about killing momentum for the unicorn shares backed by retail Reddit traders.

The blow to Robinhood’s fame could not have come at a worse time, as the corporate is planning an IPO someday in early 2021. Previous to its commerce restriction debacle, Robinhood had turn out to be one of many quickest rising buying and selling platforms on the planet, with rising customers and income attracting massive gamers and partnerships. With the plan for Robinhood to go public reportedly nonetheless energetic, will an enormous misstep with its essential base of retail traders be sufficient to offset years of momentum and development?

Since 2014, Robinhood’s development in customers has been almost exponential, rising to 13 million as of October of final yr. That quantity undoubtedly rose even increased heading into 2021 with a growth in retail traders driving distinctive shares. Robinhood’s fast development may be finest defined by its revolution in offering a easy, aesthetic app catered to attracting new, small-scale traders to the hectic world of inventory buying and selling. The stable financial development over the previous decade, previous to COVID-19, has additionally aided in boosting curiosity about investing.

Over time, Robinhood has added new options like choices buying and selling and cryptocurrency buying and selling in efforts to compete with each conventional digital brokers and new crypto buying and selling providers. Partnerships with monetary providers giants like Citadel Securities have helped it keep aggressive and monetize its monumental person base. Corporations like Citadel pay charges to Robinhood with the intention to entry real-time information on shares customers are shopping for and promoting, giving an enormous edge in figuring out inventory momentum and predicting developments. This questionable relationship has been on the radar of regulators for a while, and it has been thrust into the highlight as many declare Citadel performed an oblique position in pushing Robinhood to limit buying and selling.

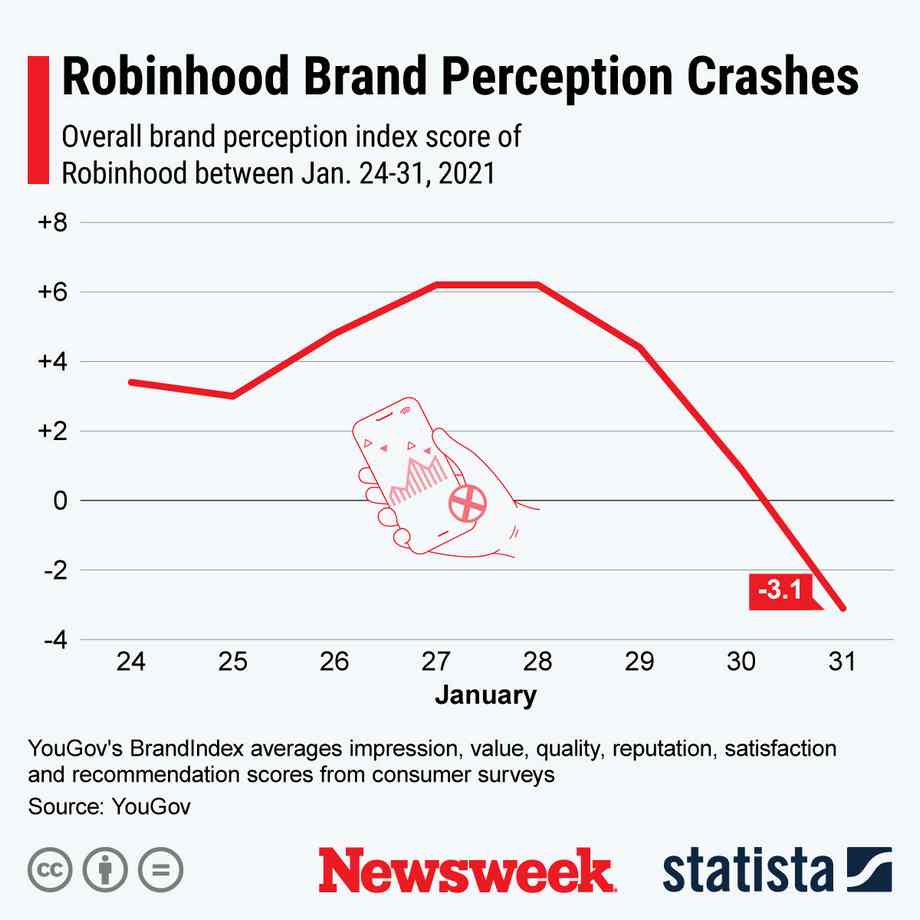

Whether or not Robinhood’s buying and selling restrictions have been well-intentioned or not, the hit to its model picture is already being visualized. Within the days throughout and after Robinhood’s share limits and buying and selling halts, digital survey firm YouGov recorded a plummeting rating for its model notion index, going from a decent 6 to an abysmal minus-3 in just some days. Reddit customers who’ve used Robinhood for years are additionally extra outspoken about leaving the platform, with many posts on the platform suggesting individuals migrate to different digital brokers.

Robinhood got here underneath fireplace earlier in 2020 after the dying of College of Nebraska pupil Alex Kearns, who killed himself after mistakenly believing he owed tons of of 1000’s of {dollars} in choices bets. The quantity owed was apparently an error, nonetheless Kearns could not contact a human consultant with customer support. Many pointed to the simplicity of conducting high-risk buying and selling on Robinhood’s platform as a harmful and predatory system.

Robinhood highlighted a vibrant, numerous future for retail investing in its new Tremendous Bowl LV advert, aiming to proceed attracting new traders in addition to reinforce its model picture of preventing for the little man. Nonetheless, an elevated focus from regulators and an enormous mark in opposition to the corporate after the GameStop surge will likely be a tricky gap to climb out of if Robinhood expects a profitable IPO within the close to future.