GameStop’s Meteoric Rise Highlights Hedge Funds’ Dangerous Brief Promoting Recreation

The meteoric rise of shares like GameStop and AMC highlighted one in every of Wall Avenue’s riskiest addictions: quick promoting. Whereas a motion of retail traders helped spur GameStop’s inventory value regardless of an absence of strong fundamentals, hedge funds’ place of roughly 121 % of shares shorted at its peak performed a key function as a rallying cry for these trying to counter a seemingly “dangerous” place. Information throughout 2020 reveals simply how a lot cash is in play for high hedge funds trying to predict the decline of an organization’s inventory value, particularly these with the ability to drive a inventory value decrease simply by making the wager within the first place.

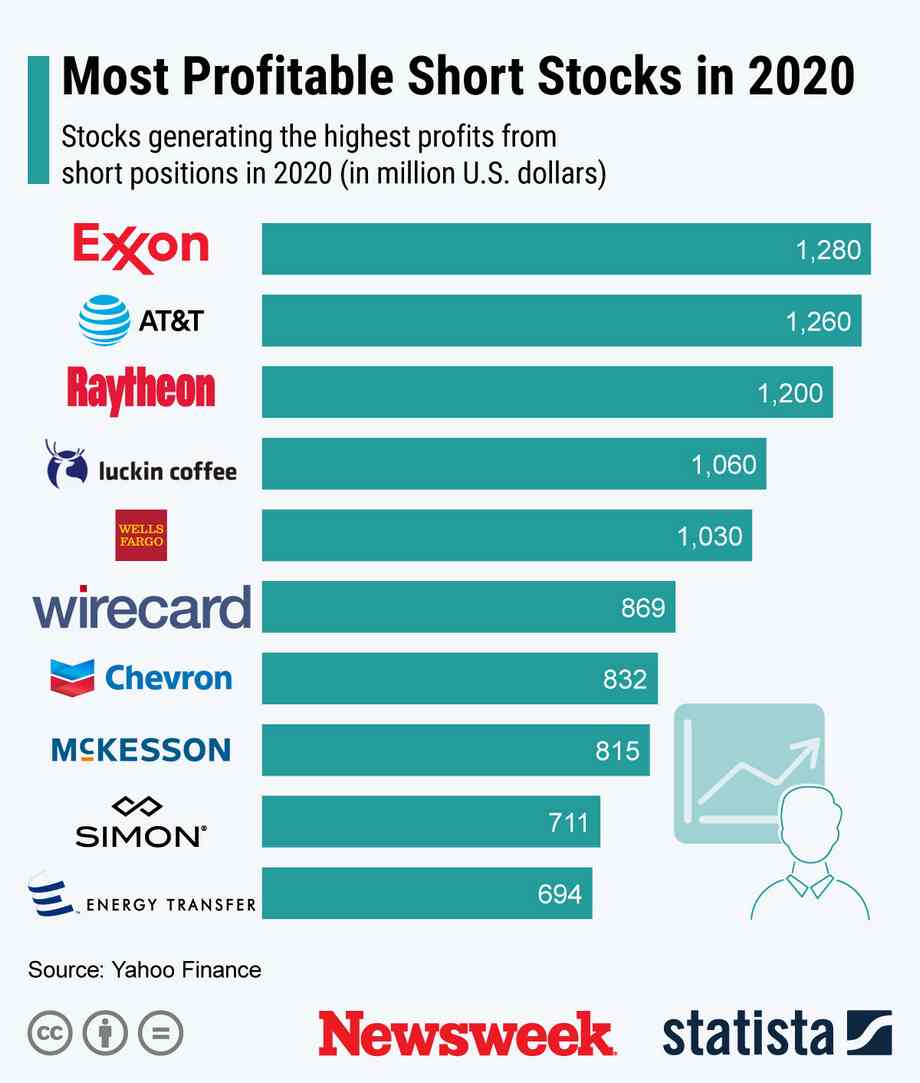

Brief promoting shares is an inherently dangerous wager because of the nature of the transaction; by borrowing shares as an alternative of shopping for them outright, traders may theoretically lose an extremely massive sum of money if the value skyrockets earlier than they buy them at an agreed-upon date. So why have been there tens of billions of {dollars} invested briefly positions in 2020 if the bets carry an added layer of threat for each retail traders and hedge funds? In the end, as proven by knowledge collected from Yahoo Finance, traders misplaced way more cash on quick positions final 12 months than they made, dropping almost $79 billion on the highest 10 positions in contrast with profiting by lower than $10 billion on probably the most profitable positions. Buyers trying to revenue from the decline of firms like Tesla, Apple and Amazon within the wake of the COVID-19 pandemic have been out of luck, whereas those that predicted the autumn of Exxon, AT&T and Raytheon have been rewarded.

The GameStop saga, whether or not it is over or not, confirmed how these putting the most important bets on quick positions normally have an implicit affect on how these positions come to an finish. The impact small retail traders have when in comparison with firms like BlackRock and Citadel appears to have been tremendously overexaggerated by GameStop’s late-January surge. BlackRock, with roughly $1.9 trillion in property managed in 2020, and Citadel, with round $29 billion in property managed final 12 months, have nice energy in how inventory costs behave simply by taking massive positions within the first place.

The quantity of GameStop trades coupled with the quick positions of main hedge funds over 2020 gave some small traders cheap confidence that the inventory was over-shorted and underpriced—resulting in a rising value that started in the course of 2020. The quick positions endured nevertheless, and a fast growth in small Reddit traders actually caught many massive hedge funds off guard. However many small traders falsely anticipated a continued surge in inventory value even past the $400 excessive it reached—a surge that, as of now, has did not materialize.

General, massive hedge funds play a special inventory market sport than small retail traders. The proscribing of buying and selling to small traders—a restriction assumably absent from the buying and selling between massive hedge funds—lends itself to that time. Market movers like BlackRock and Citadel do not simply create calculated quick positions on firms they imagine will decline; the scale of the place itself finally performs a key function in how nicely the quick place pays off.